Written by

Katie Shpak

Katie is the leader of the marketing team at BerniePortal. She oversees all content creation.

Types of Pay Periods: Choosing the Best Payroll Schedule for Your Organization

Selecting the right pay period is vital for optimizing payroll management and aligning with both company needs and employee preferences. In this guide, we’ll explore the various types of pay periods—monthly, semi-monthly, bi-weekly, and weekly—and how each can impact your organization.

Understanding the Different Types of Pay Periods

Monthly Pay Period

Definition: A monthly pay period means employees are paid once a month on a specific recurring date.

Paychecks per year: 12

Payroll date: End of the month (ex: April 30).

Hours per monthly pay period: 173.33 hours

Pros:

Simplified Benefits Management: Easier alignment with monthly benefit deductions.

Lower Processing Costs: Payroll needs to be processed only 12 times a year, reducing administrative overhead.

Cons:

Employee Cash Flow Challenges: Less frequent paychecks can make budgeting difficult for employees, especially if unexpected expenses arise.New Hire Wait Time: New employees may have to wait up to a month for their first paycheck.

Ideal Scenarios:

Suitable for businesses with a small workforce or those that can manage the infrequency of payroll without significant issues.Semi-Monthly Pay Period

Definition: Employees are paid twice a month, typically on specific dates such as the 1st and the 15th, or the 15th and the last day of the month.

Paychecks per year: 24

Payroll date: Typically the 1st and 15th or the 15th and 30th of every month.

Hours per semi-monthly pay period: About 87 hours

Pros:

Alignment with Benefit Deductions: Fits well with monthly benefit deductions.

Regular Pay Dates: Provides more regular income compared to a monthly pay period.

Cons:

Complicated Overtime and Commission Payouts: Can complicate calculations for overtime and commission due to the varying number of days in each pay period.

Not Ideal for Hourly Employees: Can create difficulties in managing pay for hourly employees due to the inconsistent number of workdays in each pay period.

Ideal Scenarios:

Suitable for businesses looking for a balance between processing efficiency and more frequent employee payments.

Bi-Weekly Pay Period

Definition: Employees are paid every two weeks, usually on a specific day like every other Friday.

Paychecks per year: 26

Payroll date: Usually every other Friday.

Hours per bi-weekly pay period: 80 hours

Pros:

Simplified Overtime Calculations: Overtime hours are always included within the same pay period.Consistent Paychecks: Employees receive paychecks more frequently, which can help with managing expenses.

Cons:

Expense Accrual Complications: Two months a year will have three pay periods, which can complicate expense accruals and accounting.Benefit Deduction Management: Requires adjustment of benefits deductions to fit the bi-weekly pay structure.

Ideal Scenarios:

Popular among companies with hourly employees or those needing to align payroll with bi-weekly accounting cycles.

Weekly Pay Period

Definition: Employees are paid once a week, typically on the same day each week, such as every Friday.

Paychecks per year: 52

Payroll date: Usually every week on a Friday.

Hours per weekly pay period: 40 hours

Pros:

Frequent Paychecks: Provides employees with regular access to their earnings, beneficial for those with irregular schedules or immediate financial needs.

Preferred by Hourly Employees: Often preferred by employees who work variable hours or have tight budgets.

Cons:

High Administrative Costs: Processing payroll weekly can be resource-intensive and costly.

Increased Time Commitment: Requires more frequent payroll processing and administrative oversight.

Ideal Scenarios:

Best for organizations with many hourly employees or those in industries where employees work irregular hours.

How to Choose the Best Pay Period for Your Organization

Factors to Consider:

- State Laws and Regulations: State regulations dictate the minimum pay period frequency. Many states require at least semi-monthly pay periods, while others, such as California and Connecticut, mandate weekly pay periods depending on the job, company size, and other factors.

- Processing Costs: Evaluate the impact of each pay period on your payroll processing budget.

- Accounting Implications: Federal law requires weekly overtime calculations, which could make the payroll process more time-consuming if you do not use an all-in-one HRIS with time and attendance, payroll, and benefits administration to reduce the risk of error.

- Benefits Deductions: The timing of benefits deductions should align with the chosen pay schedule. Both employers and employees must be clear on when these deductions occur. Ideally, you have something like BernieBill to mitigate the back-and-forth with carriers in the event a correction is needed.

- Workforce Preferences: Take into account employee preferences and financial needs to enhance job satisfaction and retention.

Note: Deciding a pay schedule may not even be an option for you. Review the Department of Labor table to see what states have payroll regulations.

Improve Your Payroll Processing with BerniePortal

Streamlining payroll can be challenging, but tools like BerniePortal offer the full suite of HR administrative capabilities to minimize challenges, reduce time spent running payroll, and improve your culture, retention, and recruitment efforts.

Ready to make your role as strategic as it can be? Learn more about BerniePortal payroll and how it's the best solution for your small to midsized business.

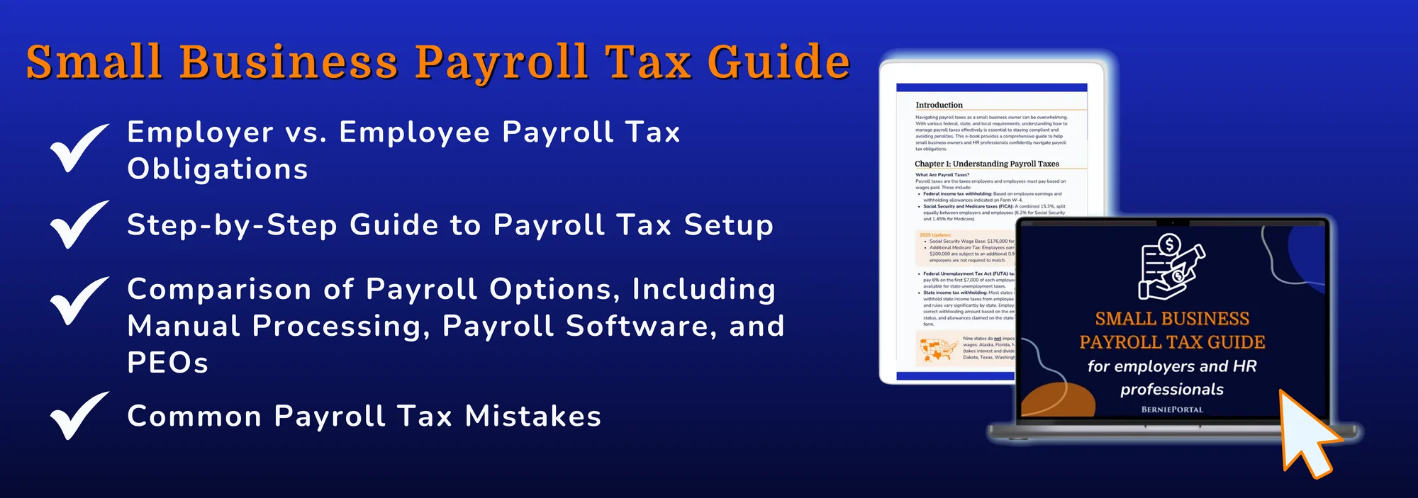

Additional Resources

You can stay informed, educated, and up to date with important HR topics using BerniePortal’s comprehensive resources:

- BernieU—free online HR courses, approved for SHRM and HRCI recertification credit

- BerniePortal Blog—a one-stop shop for HR industry news

- HR Glossary—featuring the most common HR terms, acronyms, and compliance

- Resource Library—essential guides covering a comprehensive list of HR topics

- HR Party of One—our popular YouTube series and podcast, covering emerging HR trends and enduring HR topics

Written by

Katie Shpak

Katie is the leader of the marketing team at BerniePortal. She oversees all content creation.

Related Posts

Part-time work is becoming increasingly common in today’s workforce—especially for...

As you know, healthcare and benefits can be complicated, which can make the enrollment...

With the deadline for filing and distributing 1095-C forms approaching, staying...

A strong paid time off (PTO) policy helps retain current talent and attract prospective...

Submit a Comment