How to Design an Employee Benefits Package

The ultimate employee benefits starter guide, covering everything you need to know about fringe, ancillary, voluntary, statutory, and other employer benefits offerings. “How to Design an Employee Benefits Package” will walk you through the necessary steps to choose the right benefits programs for your organization, how and when to communicate benefits information to employees, and staying up to date on emerging and trending benefits, giving your organization a competitive advantage in the marketplace.

Many small and mid-sized organizations offer group benefits to employees as a way to retain and attract talent. This how-to guide explains common benefits questions, terminology, and strategies that smaller organizations can use to provide a solid foundation for employee benefits.

How Benefits Give Employers a Competitive Edge

Retention:

Employee benefits are key to keeping employees happy—an essential factor in employee retention. According to a recent SHRM Employee Benchmark Survey—

92% of employees surveyed indicated that employee benefits significantly impacted overall job satisfaction.

And employers are listening. The same survey indicates that—

“of the 34% of organizations that increased benefits offerings in the last 12 months, 72% cited retention as a reason for doing so.”

Talent acquisition:

Candidate recruitment has become increasingly competitive. And, unfortunately, hiring managers and human resources personnel at small and mid-sized organizations often struggle to find and keep quality talent.

To hire top candidates, organizations need to not only speed up their recruiting process but also optimize their benefits package. Building competitive offerings makes organizations more attractive to prospective hires and increases the likelihood that they add great candidates to their team.

Performance:

The SHRM survey also indicates that—

“organizations that use benefits as a strategic tool for recruiting and retaining talent reported better overall company performance”

— and this difference is significant. Organizations that offer strategic benefits—in other words, benefits that actually fit the profile and needs of their team—are almost two times more likely to employ more satisfied workers than those that don’t offer strategic benefits.

What Benefits Should I Offer?

Benefits Classifications

Fringe benefits:

The IRS classifies fringe benefits as “a form of payment for the performance of services” outside of an employee’s regular wages. Put simply, fringe benefits are generally any extra benefit an employee receives, in addition to, or instead of a salary for services provided.

It is important to note, however, that an individual doesn’t necessarily need to be an employee to receive fringe benefits. Independent contractors, partners, or directors performing services for an organization may also receive fringe benefits. Here are some common fringe benefits:

- Health insurance

- Tuition assistance

- Company-paid meals

- Wellness programs

- Paid time off (PTO) for paid vacation, sick time, & personal time

- Commuter benefits

- Health savings accounts (HSA)

Ancillary benefits:

Ancillary benefits are all non-health plan benefits, including secondary types of health insurance that cover miscellaneous medical expenses. Common examples of ancillary benefits include:

- Vision insurance

- Dental insurance

- Life insurance

- Short-term disability insurance

- Long-term disability insurance

Each of these benefit types can be classified as both a fringe benefit and an ancillary benefit.

Voluntary benefits:

Voluntary benefits are benefit plans that are available to employees without the financial assistance of the employer. These benefits require employees to pay the full premium required by the carrier and are funded by employee payroll deductions.

For example, some employers offer voluntary life benefits outside of the core benefits package offered to employees. If an employee wants to enroll in voluntary life, that means that the employee would be responsible for the full cost of coverage. The organization only subsidizes the cost of the core benefits such as health, dental, vision, and life, not voluntary life.

Statutory benefits:

Statutory benefits are employee benefits that are required by law.

According to the Bureau of Labor Statistics, statutory benefits are those that “provide workers and their families with retirement income and medical care, mitigate economic hardship resulting from loss of work and disability, and cover liabilities resulting from workplace injuries and illnesses.”

Here are a few examples of statutory benefits:

- Unemployment insurance (UI)

- Workers’ compensation insurance

- Health insurance (50+ employees or part-time equivalent)

- Family medical leave (FMLA) (50+ employees or part-time equivalent)

- COBRA coverage

Top Employee Benefits

Not all benefits are created equal. From trending to always-popular, often the most attractive employee benefits help keep turnover rates low on teams. Rather than simply offering increased wages, employers are increasingly offering unique benefit packages that reflect company culture and employee preferences.

Consider five of the most attractive employee benefits:

Better health, dental, and vision insurance:

While non-insurance benefits are gaining in popularity, health, dental, and vision insurance remain the most popular employee benefit. In fact, 88% of workers surveyed reported that they would consider or heavily consider a position with good insurance options for these three segments.

More flexible hours:

The rise in the Millennial workforce has greatly changed the culture of the working world. Increasingly, employees seek positions that permit work hour flexibility. No, this doesn’t mean that the employee gets free reign. It just means that the employee has more options as to what time of day work is done and where a task is accomplished. By offering employees more autonomy over their schedule, employers increase overall employee satisfaction and are much more likely to retain the employee.

More vacation time:

Similarly to employee preference for flexible work hours, workers express greater interest in supplemented vacation time. Some employers even offer unlimited vacation days — another extremely popular benefit.<br /> If you’re an employer, you’re probably thinking, “Of course they want vacation days…how will more vacation help my business?” Increasing employee vacation time can actually benefit you and your employee. In fact, according to CNN’s interview with expert Brigid Schulte, those who forgo vacation time are, “sicker, less productive, stressed, and more anxious and depressed.” In sum, vacation allows employees time to rest which makes them better workers when they return to the office.

Work-from-home options:

With the rapid change in technology, more employees are able to perform day-to-day tasks remotely. The option to work from home allows more flexibility in personal life which, in turn, results in an increase in worker productivity. In addition to an increase in productivity, employees working from home also exhibit greater peace of mind, better physical health, and improved relationships.

Student loan assistance:

More frequently, employers are offering student loan assistance as a benefit opportunity for employees. This benefit is particularly popular with the younger demographic transitioning into the workforce. While this particular benefit type is not currently prevalent, the Consumer Financial Protection Bureau anticipates a significant increase in employer coverage of student loan repayment in the near future.

Other popular employer-paid benefits:

- Tuition assistance

- Paid maternity/paternity leave

- Free gym membership

- Free daycare services

- Free fitness/yoga classes

- Free snacks

- Free coffee

- Company-wide retreats

- Weekly free employee outings

- On-site gym

- Team bonding events

While these benefit preferences are a good starting point, the attractiveness of benefits to employees also depends on specific job characteristics, as these might be different from national averages.

Factors to Consider When Selecting Benefit Offerings

Time and again, stellar employee benefits have proven to be a great tool for organizations looking to boost recruitment and retention rates. As such, it’s important for organizations understand benefits trends at large, but also how unique factors may affect their employees’ preferences and participation.

When choosing employee benefits offerings, take into consideration:

Dominant workforce ideals:

Millennials are becoming the dominant demographic in the working world and therefore have a significant influence on the workplace culture. Because of this presence, an employer must create a benefits package that a millennial will find useful.

Personalization:

The workforce is becoming increasingly focused on personalization, so well-thought-out benefits speak volumes to potential hires. For example, if your staff base typically falls between 25 and 30 years old, it would make sense to offer childcare benefits. However, for a company predominantly composed of baby boomers, robust retirement benefits may be more appropriate. Likewise, it would be prudent to offer tuition assistance benefits for when your target demographic is younger.

Competitor offerings:

Organizations should also evaluate the benefits packages offered by competitors. Conducting research on common benefit offerings within a given industry provides employers insight into the employee wants and needs when it comes to benefits. Using this information, employers can offer benefits that employees want in their compensation package and, as a result, increase employee retention.

Trending Benefits

In addition, organizations should tailor and adjust benefits offerings based on trends impacting their respective industry and the economy. As a result, organizations can address these trends by adding new benefits (or improving existing offerings).

Consider adding or tweaking six popular benefits in the coming year:

- Employer Contributions to Health Savings Accounts (HSA): According to SHRM’s 2019 Healthcare and Health Services report, more than 50% of employers offered HSAs alongside high-deductible health plans. Better still, 39% of these employers made contributions to their employees’ HSAs. It goes without saying that helping your team bolster healthcare savings by lessening their employee contribution percentage can go a long way towards recruitment and retention.

- Employee Assistance Programs (EAPs): Given everything that’s already happened in 2020—a once-in-a-century pandemic and record unemployment, for example—EAPs seem a natural fit for the upcoming year. An EAP assists workers with personal or work-related problems that may impact their job performance, health, and mental and emotional wellbeing. They also generally offer free and confidential assessments, short-term counseling, referrals, and follow-up services for employees.

- Personalized Supplementary Benefits: In the same 2019 SHRM mentioned above, the study points out that “supplemental insurance plans provide both convenience and value for the employer and the employees.” By focusing on personalization—benefits that match an employer’s workforce demographics—teams can craft voluntary packages that draw increased interest and enrollment. For example, if your staff base typically falls between 25 and 30 years old, it would make sense to offer childcare benefits.

- Student Loan Assistance: More frequently, employers are offering student loan assistance as an option for employees. This benefit is particularly popular with the younger demographic transitioning into the workforce. While not widely prevalent—SHRM reported an increase from 4 to 8% in employers offering the program, from 2018 to 2019—the Consumer Financial Protection Bureau anticipates a significant increase in employer coverage of student loan repayment in the near future.

- Telemedicine and Telehealth Options: SHRM’s 2019 study also concluded that telemedicine and telehealth coverage increased by 10% from 2018 to 2019. It’s safe to say that the coronavirus has only accelerated the adoption of these services. According to the CDC, “recent policy changes during the COVID-19 pandemic have reduced barriers to telehealth access and have promoted the use of telehealth as a way to deliver acute, chronic, primary, and specialty care.”

- Benefits that Make Workplaces Friendlier: People like working for companies that make their lives better. The 2019 SHRM report indicated that benefits such as childcare, eldercare, onsite mother’s rooms, and even pet insurance are popular among millennials, who are now the largest active generation in the workforce.

How Much Do Group Health Plans Cost?

Health plan costs vary substantially depending on the type of plans offered, the region in which your business operates, and the demographic makeup of your employees. That said, on average, annual premiums for single coverage for small businesses total $6,972 and annual premiums for family coverage total $20,486, according to the Kaiser Family Foundation.

Small group premiums tend to be more expensive in the Northeast and are less expensive in the West, with the Midwest and South close to the national averages.

How much of the premium are employers responsible for? Carriers used to require a 50% contribution for at least the employee-only premium. Some carriers and groups will allow for a smaller percentage, but it depends on the situation.

Costs can be contained in a number of ways for small groups, including implementing different funding strategies or plan designs such as HSA-eligible plans.

Do I Have to Offer the Same Benefits to Everyone?

Ultimately, it depends on the benefit and how many hours an employee works. For example, ALEs are required by the Affordable Care Act (ACA) to offer health benefits to all employees who work at least 30 hours per week or 130 hours per month despite whether or not they’re considered full-time or part-time by the employer.

Whether or not organizations offer benefits depends largely on what the benefits are, how many people work for the employer, and—in some cases—whether or not the employer is federally contracted. For the most part, organizations are not required to offer benefits like PTO at all to any employees—full-time or not.

The ACA also states that employee benefits should not discriminate on the basis of race, color, sex (including pregnancy), national origin, religion, or sexual orientation. These laws also prohibit the segmentation of benefits that favor highly compensated individuals.

Title VII of the Equal Employment Opportunity Commission (EEOC) mandates that an individual’s eligibility for benefits, the number of benefits received, or the premium charged to participate in employer-offered benefits cannot be determined on the basis of race, color, sex (including pregnancy), national origin, age (ADEA), or religion.

Likewise, the Health Insurance Portability Accessibility Act (HIPAA) prohibits employers from offering group benefits that discriminate against individuals based on health factors such as:

- Health status

- Medical condition (including both physical and mental illnesses)

- Claims experience

- Receipt of health care

- Medical history

- Genetic information

- Evidence of insurability; or

- Disability

HIPAA also regulates discrimination in regards to Cafeteria plans (Section 125 plans), plans that provide employers an opportunity to choose “among at least one taxable benefit (such as cash) and one qualified benefit.” Under HIPAA, group benefits cannot discriminate in favor of highly compensated employees in terms of eligibility, contributions, and/or benefits. Because this is a tax-related law, the Internal Revenue Service (IRS) enforces these regulations.

Some states may also have laws in place that limit the employer’s ability to segment employee benefits by group. For instance, some states have paid sick leave laws in place that require employers with 50 or more employees to offer paid leave to all employees. Find employee discrimination laws for your state.

So how can you segment employee benefits? Employers can legally offer different benefits to “similarly situated individuals” based on classes such as:

- Tenure

- Part-time or full-time status

- Exempt or non-exempt status

- Job group

- Department

- Union involvement

- Location

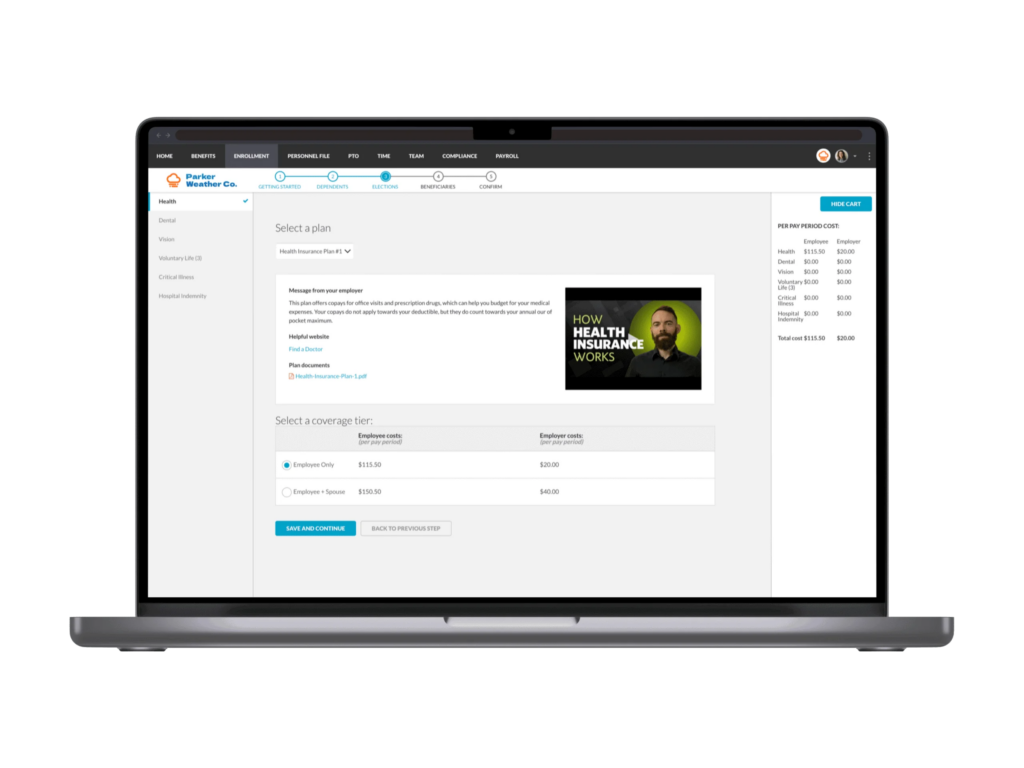

Benefit Administration Systems and Open Enrollment

Benefits are extremely complex and require keen attention to detail, significant time commitment, industry knowledge, and compliance expertise. A broker will help clients select the best benefits packages for their unique needs and guide that employer through open enrollment, billing, and problem resolution.

This process is even more streamlined using a human resources information system (HRIS). These intuitive systems offer benefits administration capabilities that make open enrollment a breeze. Learn more here.

What is Benefits Open Enrollment?

Open Enrollment is the timeframe where an employer’s benefits renew and employees can change their elections. Aside from qualifying events, this period is the only time in which workers are permitted to adjust or update important benefits like healthcare coverage and voluntary life insurance.

Typically, small and mid-sized employers rely on trusted brokers and brokerages to help them select and administer benefits packages that are tailored to their teams.

How to Choose a Broker

Choosing a health insurance broker is a tedious task. You want a broker that can keep your benefits spend down without sacrificing any offerings that help you recruit and retain employees. The good news? There are brokers who care about your business and your employees just as much as you do.

Here are some tips that you can follow to make sure you’re choosing the right broker:

1. Consider all of your options:

You can never consider too many brokerages. There are lots of brokerages out there, some will go above and beyond to keep your costs low without sacrificing benefits, most will just follow market trends.

2. Ask questions:

A good broker will be able to field all of your questions about alternate financing, plan administration, and compliance. Here’s a link to some questions you should ask your broker.

3. Talk to your friends:

If you’ve noticed that other businesses are keeping the cost of their health plan down, don’t hesitate to ask how they’re doing it.

4. Ask about the broker’s clientele:

If the broker is having a hard time holding on to clients, chances are they’re not a good fit for you.

5. Don’t be afraid to make a change:

You’ve got to do what’s best for your business. Shopping around could save you a lot of money!

How to Communicate Benefits to Employees

Employee benefits communication and education is a common struggle that plan administrators face yearly—but that doesn’t mean you need to accept the status quo.

Employees commonly report feeling stressed about benefits—which benefits to choose, how much those benefits will cost, and how each covered individual will be affected by those benefits decisions. To ease this stress, employers and HR must prepare for open enrollment accordingly and establish clear and accessible communication channels in order to inform employees of their benefits.

Evaluate communication channels:

Consider how your employees most commonly access information. Are your employees constantly on social media? Do they relentlessly check their email? By identifying your employees’ most-used communication channels, you can identify the modes of communication that are best suited for your company. For instance, if your company has an intranet that employees frequently check, you could post benefits information on the intranet.

Understand employee preferences:

MetLife conducted a study to evaluate employee preferences for benefits communication. In this study, MetLife gathered feedback from employees who rated their company’s benefits communication A or B-level. According to SHRM, MetLife determined that employers want:

- Guidance from employers

- Simplified benefits content

- Life event-specific benefits information

- In-person benefits help

- Online decision support tools

- Written confirmation of benefit elections

- Ongoing benefits education

Use an email template:

Effective communication has never been more crucial for successful open enrollment, especially if an organization is operating remotely or in a hybrid model. Use this email template to help guide your employees on the benefits selection process and facilitate a smooth open enrollment process.

What Benefits Information to Communicate to Employees

Among the countless responsibilities HR professionals oversee on a daily basis, compliance remains one of the most vital for the continued success of every organization. While there are more strategic projects that require HR’s attention—such as applicant tracking, performance management, and more—without compliant policies, employers run the risk of running the business into the ground. Benefits communications fall under this umbrella.

The Employee Retirement Income Security Act (ERISA) mandates that plan administrators must provide participants with the most important information about their retirement, health benefit plans, and materials about the operation and management of these plans.

Most employers are required to provide the following benefits notices to employees:

- Health insurance plan and benefits coverage options

- COBRA information

- Information about the FMLA

- HIPAA information

- Medicare Part D Notice of Creditable Coverage

- Other required benefits notices

When to Communicate Benefits with Employees

Unfortunately, benefits communication can’t just be a “one and done” sort of venture. In order to truly reach employees, administrators need to repeatedly communicate benefits to employees using a variety of communication channels.

When should you start? A rule of thumb is to start communicating benefits three months prior to open enrollment. By planting the seed early, administrators give employees ample time to consider their benefit options and to ask questions prior to enrollment.

Intermittently in these three months prior to enrollment, continue to provide employees with helpful and informational benefits content. By keeping communication consistent, administrators encourage employees to continue thinking about benefits.

Right before enrollment, organizations should arrange an in-person presentation of benefits to all employees. This session should be a “crash course” in a company’s employee benefit offerings. Because this lesson is conducted just before enrollment, it allows employees to complete enrollment with benefits fresh in their minds.

Communicating Benefits with BerniePortal

BerniePortal is an online HR and benefits platform that streamlines common administrative challenges faced by small to mid-sized businesses.

The all-in-one HRIS simplifies the overall open enrollment process by providing a benefits enrollment experience to its users that’s intuitive and easy to use. As a result, HR can worry less about submitting benefits paperwork and more about strategic projects that make the team better.

Ready to Go Online With BerniePortal?

See all the benefits and capabilities of BerniePortal’s all-in-one benefits administration & HR software.